A financial advisor’s blog can be a powerful tool — learn the metrics you need to optimize to get the most out of it.

You know firsthand how important it is to track the success of your content marketing efforts.

After all, if you're not measuring the effectiveness of your strategies, you won't know what's working and what's not.

In this post, we'll dive into the top metrics that financial advisors should be tracking when evaluating the impact of their blog posts.

These metrics will give you a clear picture of how well your blog performs and help you make informed decisions about optimizing your content for success.

From traffic and engagement to lead generation and conversion rates, we'll cover the key metrics you need to be aware of to ensure your blog reaches its full potential.

By the end of this post, you'll have a solid understanding of the metrics that matter most for financial advisors and how to track them effectively.

How Often Should Financial Advisors Blog?

Financial advisors should frequently blog to generate leads and traffic to their websites.

According to research by Hubspot, companies that publish 16 or more blog posts per month get about 4.5 times more leads than those publishing 1 to 4 per month.

Furthermore, those companies that publish over 16 blog posts per month get 3.5 times more traffic than those publishing less than five times per month.

How To Generate A High Volume of Blogs

But it's not just the frequency of your blog posts that matters – it's also the cumulative volume. Hubspot found that businesses that eventually published 400 or more posts got twice as much traffic as those who published less.

So, how can you achieve these high volumes of blog posts as a financial advisor?

One option is to do all the content in-house if you have associates who enjoy writing and are capable of producing high-quality content.

Alternatively, you can generate ideas and hire a financial advisor ghostwriter to turn them into polished, finished articles.

You can also hire a ghostwriter to generate ideas for you to review and turn into finished articles.

Or, you could do a combination of these options.

One of the more popular options today is to use artificial intelligence-powered writing tools.

Artificial intelligence (AI) can help streamline many jobs and AI writing tools can write a blog post for you in seconds.

You’ll need to give input on what you want to produce and edit the outputs, but overall, they are an excellent content production tool.

Create financial assessments for your audience. The results offer you a huge amount of information to create several blog posts tailored to financial advisors.

If you're a small firm or working on a tight budget, you can draft or record ideas and turn them into full-blown articles.

You can also publish a series of posts on a single topic, breaking it down into several chunks.

Why Should Financial Advisors Pay Attention To Metrics For Their Blogs?

Metrics can be a little complicated but knowing what they are and how they can be optimized is crucial if you want to maximize your blog’s success.

Here are the top reasons financial advisors should look at their blog site metrics.

- Understand the reach of your content: By tracking metrics like traffic and engagement, you can get a sense of how far your content is reaching and how well it resonates with readers.

- Generate leads: Lead generation is crucial for financial advisors looking to grow their client base. You can get an idea of how effectively your blog converts visitors into leads by tracking metrics like conversion rate.

- Optimize your content: By tracking metrics like time spent on your website and conversion rate, you can identify areas for improvement and optimize your content to meet the needs of your audience better.

- Improve your search engine rankings: Google and other search engines love fresh, high-quality content. Regularly publishing blog posts can improve your search engine rankings and make it easier for potential clients to find your website.

By staying on top of these metrics, you can ensure that your blog reaches its full potential and helps you to grow your business.

What Are the Top Metrics Financial Advisors Need To Look At?

Here are the top metrics you should optimize to get the most out of your blog posts.

Metric #1: Traffic

As a financial advisor, tracking the traffic to your blog is crucial because it gives you an idea of the reach of your content.

The more traffic your blog receives, the more potential clients you can reach.

You can use several tools to track the traffic to your blog.

One of the most popular is Google Analytics, a free tool that provides a wealth of information on your website's traffic.

You can use Google Analytics to see how many visitors your blog receives, where they are coming from, and how they interact with your site.

Another tool you can use to track traffic is your website logs.

These logs provide detailed information on the visits to your blog, including the visitor's IP address, the pages they visited, and the length of their stay.

By analyzing this data, you can better understand the traffic to your blog and how your content resonates with readers.

Tracking traffic also helps you understand your content's reach and identify areas for improvement.

Using tools like Google Analytics and website logs, you can gain valuable insights into the performance of your blog and make adjustments as needed to attract more visitors.

Metric #2: Engagement

As a financial advisor, it's not enough to simply attract visitors to your blog – you also want to keep them engaged and interested in your content.

That's where engagement comes in.

Engagement refers to the interactions readers have with your blog, such as commenting, sharing, and liking your posts.

These interactions indicate that readers are interested in and invested in your content, and high levels of engagement can lead to increased traffic through word-of-mouth recommendations and earning backlinks.

There are several tools you can use to track engagement on your blog.

One option is to use the analytics provided by your social media accounts.

For example, you can use the insights feature on Facebook to see how many people are interacting with your posts and the types of interactions they are having.

Another tool you can use to track engagement is your blog's commenting system.

By monitoring the comments on your blog, you can get a sense of how readers respond to your content and engage with them directly.

Tracking engagement on your blog gives you an idea of how interested and invested readers are in your content.

Using tools like social media analytics and your blog's commenting system, you can gain valuable insights into the performance of your blog and make adjustments as needed to keep readers engaged.

Metric #3: Lead Generation

As a financial advisor, one of your main goals is to attract new clients.

Lead generation draws in and converts website visitors into potential customers, which is essential to growing your business.

Several tools can be used to track lead generation on your blog.

One option is to use landing page software, which allows you to create dedicated pages on your website specifically designed to capture leads.

By analyzing the data from your landing pages, you can see how effectively they convert visitors into leads.

Another tool you can use to track lead generation is your blog's contact form submissions.

By monitoring the sign-ups you receive through your contact form, you can get an idea of how many visitors are expressing interest in your services.

Lead generation is crucial for financial advisors because it helps build your client base.

Using tools like landing page software and tracking contact form submissions, you can gain valuable insights into the performance of your lead generation efforts and make adjustments as needed to attract more potential clients.

Metric #4: Time Spent on Website

It's important to track the time visitors spend on your website to understand how effectively your content keeps them engaged.

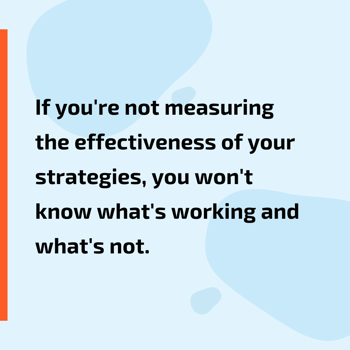

HubSpot says 55 percent of visitors spend fewer than 15 seconds on a website.

Therefore, you must clearly and quickly communicate your unique value proposition to tell visitors about your company and why they should choose to work with you.

By tracking the time spent on your website, you can see whether your content is effectively reeling in visitors and keeping them engaged.

To track the time spent on your website, you can use the home section of Google Analytics. Under the Audience tab and then click on Overview.

By tracking the time spent on your website, you can better understand how effective your content is at engaging visitors and adjust your strategy as needed to improve your performance.

Metric #5: Conversion Rate

As a financial advisor, it's not enough to simply attract visitors to your blog or generate leads – you also want to convert those visitors into clients.

That's where the conversion rate comes in.

Conversion rate refers to the percentage of visitors who take a desired action on your blog, such as filling out a form or subscribing to your newsletter.

This metric is important because it shows how effectively your blog turns readers into clients.

Several tools can be used to track your blog's conversion rate.

One option is to use AI-based landing page software, which allows you to create dedicated pages on your website specifically designed to capture leads.

By analyzing the data from your landing pages, you can get a sense of your conversion rate and identify areas for improvement.

Another tool you can use to track conversion rates is your blog's contact form submissions.

By monitoring your contact form sign-ups, you can know how many visitors are taking the desired action and becoming potential clients.

Tracking conversion rate is vital for financial advisors because it helps you understand your blog's effectiveness at turning readers into clients.

Using tools like landing page software and tracking contact form submissions, you can gain valuable insights into the performance of your blog and make adjustments as needed to increase your conversion rate.

Conclusion

In conclusion, it's important to track various metrics to understand your blog posts' impact.

Tracking the metrics above can help you to understand what is and isn't working on your blog and make adjustments as needed to maximize the impact of your blog posts.

Using tools like Google Analytics, social media analytics, and landing page software, you can gain valuable insights into the performance of your blog and take steps to improve its effectiveness.

Tracking these metrics is crucial for financial advisors looking to build their client base and succeed in the competitive world of online marketing.

By staying on top of these critical metrics, you can ensure that your blog reaches its full potential and helps you to grow your business.

|

Author Bio Andrew Dunn is a serial business builder with over seven years of experience growing businesses. He is the founder of INDMND.com, providing valuable insights for business owners to leverage technology to 10x their businesses. He is passionate about scaling businesses using SEO and content marketing. |

.png)